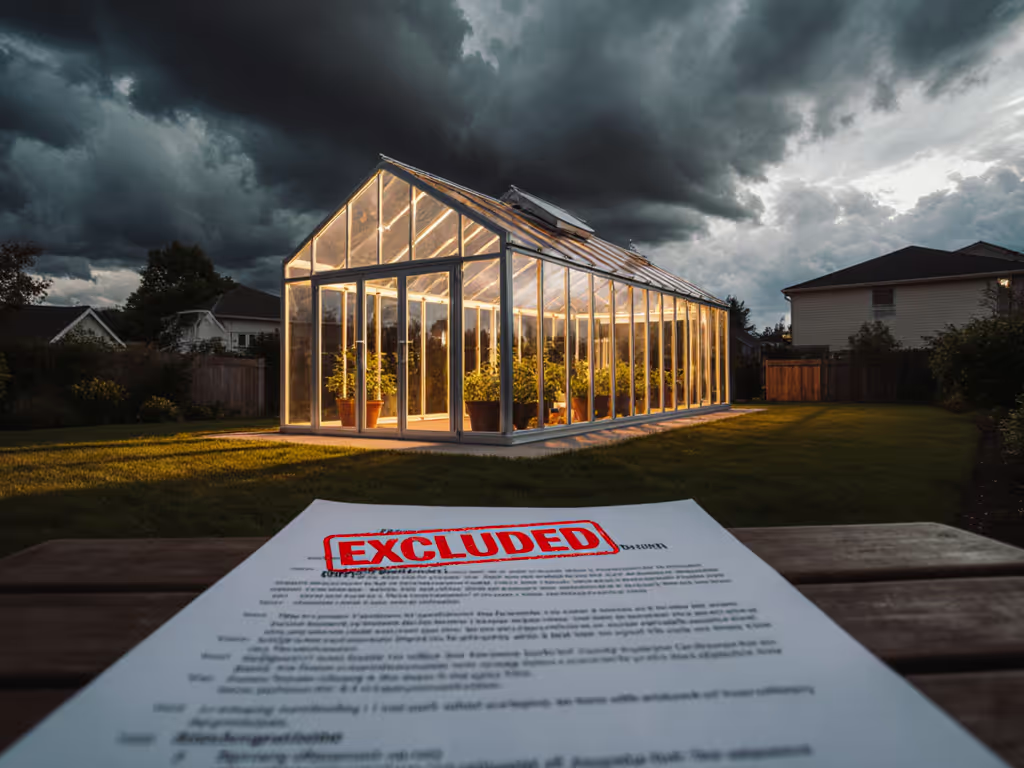

Your Home Insurance Won't Cover That Greenhouse

If you're eyeing greenhouse kits for your backyard farming ambitions, you need to confront a hard truth: your home insurance likely excludes these structures. Greenhouse insurance requirements demand more than just slapping together any kit you find online. Most standard homeowners policies treat greenhouses as "detached structures" with severe limitations, typically capping coverage at 10% of your dwelling value, with strict construction standards. I've walked through fields after winter storms, seeing crushed hoops that looked fine on paper but failed catastrophically under load. Your plastic bubble might work for seedlings, but it won't meet insurance criteria for permanent structures. Let's cut through marketing fluff and examine what actually passes muster with insurers.

Wind is a test you schedule for. And right now, most homeowners aren't scheduling it properly.

Why My Home Insurance Doesn't Cover My Greenhouse

Don't assume add-ons get automatic coverage

Most homeowners don't realize their policy doesn't automatically cover new structures. A standard HO-3 policy typically covers "other structures" (like sheds) at just 10% of your dwelling coverage, often insufficient for anything beyond a $2,000 plastic pop-up. If your $15,000 kit sits on wooden skids without permanent anchoring? It's probably excluded. One carrier I work with explicitly voids coverage for structures "not secured to a permanent foundation." For anchoring that meets code and carrier expectations, see our guide to soil-specific greenhouse foundations. This isn't arbitrary. After a Midwest derecho, I saw EAGLE PEAK-style pop-up greenhouses wrapped around trees while anchored hoop houses stood firm.

Why "temporary" structures get denied coverage

Insurance carriers categorize greenhouses based on permanence. If your structure:

- Uses temporary anchors (rebar stakes, sandbags)

- Has no permanent foundation

- Uses thin-gauge framing (<1.5" tube steel)

- Lacks proper bracing

...it's classified as "temporary equipment" rather than a permanent structure. Most policies exclude temporary structures from coverage. One grower I advised paid $8,000 for a "premium" kit only to discover his carrier classified it as "seasonal equipment," not covered for wind damage. The critical threshold? Permanent attachment to a foundation meeting local code (typically 12"-deep concrete piers or helical anchors). Anything less becomes a liability loophole insurers won't touch.

EAGLE PEAK 8x8 Portable Walk in Greenhouse

What Makes a Greenhouse Actually Insurable?

Structural non-negotiables insurers require

Carriers want proof your greenhouse can withstand regional loads. In snowbelt regions, this means minimum 30 PSF snow load capacity; in coastal zones, 90+ MPH wind ratings. If you garden up north, start with our cold climate greenhouse kit comparison to find verified snow-load options insurers accept. I've seen claims denied because:

- Roof pitch was <3:12 (traps snow)

- No knee braces at hoop intersections

- Anchors lacked 12" embedment depth

- No wind bracing on end walls

After that coastal storm where I rebuilt failed structures, the new standard became helical anchors at 16" intervals, 22-gauge steel frames, and 45-degree roof pitches. These weren't just best practices; they were insurance requirements. Document your structural specs: insurers want engineering stamps showing compliance with ASCE 7 standards. Keep those records handy.

The liability trap many growers miss

It's not just structure: greenhouse liability considerations can sink you. One nursery owner faced a $150,000 claim when a customer slipped on wet greenhouse flooring. Standard homeowners policies exclude business-related injuries. If you sell produce, host workshops, or even give away surplus, you need separate liability coverage. Most carriers require:

- Commercial general liability (min $1M)

- Slip-resistant flooring documentation

- Safety signage at entrances

- Proof of regular structural inspections Use this seasonal greenhouse maintenance checklist to document inspections and preventative care for your insurer.

Climate-specific requirements you must know

Requirements vary dramatically by region. In Minnesota, insurers demand 50 PSF snow load capacity with automatic roof vents; in Florida, hurricane straps and 130 MPH wind certifications. Coastal growers should also review our coast-proof greenhouse kits guide for materials and hardware that resist salt-air corrosion while meeting wind codes. Recent carrier guidelines I've reviewed show:

| Region | Snow Load Requirement | Wind Rating | Critical Features |

|---|---|---|---|

| Northeast | 40-50 PSF | 90 MPH | Heated gutters, 45° pitch |

| Midwest | 30-40 PSF | 100 MPH | Cross-bracing, concrete anchors |

| Coastal | 20-30 PSF | 130+ MPH | Hurricane straps, polycarbonate glazing |

| Southwest | 10-20 PSF | 90 MPH | Shade systems, thermal mass flooring |

A structure built for Arizona won't meet insurance specs in Vermont. Check your carrier's regional addendum, and it's often buried in the fine print.

Three Critical Steps to Get Your Greenhouse Covered

1. Document structural integrity BEFORE building

Call your insurer before purchasing a kit. Request their greenhouse construction checklist (I carry laminated cards with minimum specs). Get written confirmation that your planned structure meets requirements. Last year, a client avoided $12,000 in rejected claims by having his engineer stamp anchor specs showing 18" helical depth and 120 MPH wind rating.

2. Upgrade anchors to insurance-grade specs

Most DIY kits ship with inadequate anchors. The fix:

- Upgrade to 1.5" helical anchors minimum

- Space anchors ≤16" on center (not 48" like budget kits)

- Torque to 250+ ft-lbs (verify with gauge)

- Install horizontal wind braces at 45°

This costs 15% more upfront but prevents 100% of coverage denials from structural failure. Overbuild once; sleep through the wind warnings at night.

3. Get separate liability coverage if selling anything

Even giving away surplus plants can void homeowners liability. For under $500/year, a $1M business liability policy covers:

- Customer injuries

- Product contamination claims

- Structural failure lawsuits

- Equipment damage

One community garden collective paid $300 for this coverage and had it cover a $10,000 equipment claim when their vent motor failed during a freeze.

The Bottom Line: Insurance Starts With Your Foundation

Your greenhouse isn't just a garden accessory (it's a major structural investment requiring proper protection). Insurers don't care about "easy setup" or "spacious interior"; they care about engineering specs that prevent failure. When evaluating greenhouse kits, prioritize:

- Permanent foundation compatibility

- Documented load ratings (wind/snow)

- Commercial-grade liability options

- Engineer-stamped construction plans

Overbuild once, sleep well always. Resilience is the cheapest insurance you'll ever buy.

Coverage gaps happen when growers prioritize speed over structure. I've rebuilt enough collapsed hoops to know: the $200 you spend upgrading anchors today prevents the $15,000 claim denial tomorrow. Don't assume your home insurance covers that greenhouse. Verify, document, and build to insurance-grade specs from day one.

Action Step: Your 24-Hour Coverage Check

- Call your agent today: ask specifically, "What structural requirements must my greenhouse meet for full coverage?" Get written specs.

- Measure your kit against requirements: if anchors are <12" deep or framing <1.5" diameter, contact the manufacturer for upgrades.

- Document everything: take photos of installed anchors, keep engineering certs, and get written confirmation of coverage scope.

Your plants depend on that structure. Make sure your insurance does too.